A Director’s Guide to the Small Business Restructuring Process

That sinking feeling in your gut when cash flow is tight isn't just stress—it's often the first real signal that your business needs attention. I've seen too many directors wait too long, pinning their hopes on a miracle sales month to fix everything.

The secret to a successful turnaround? Spotting these subtle signs early. Acting decisively now, before a crisis hits, opens up a world of recovery options that simply vanish once things spiral.

Recognizing the Early Warning Signs of Financial Distress

Financial trouble rarely ambushes you overnight. It’s more of a slow burn, a series of small compromises and mounting pressures that are all too easy to brush off as "just a tough month." Ignoring them is one of the biggest mistakes a director can make.

The signs are often practical, not just numbers on a spreadsheet. It's the mental gymnastics you perform when deciding which suppliers to pay this week, knowing you can't cover them all. It's that feeling of relying on a new sale just to pay last month's bills, creating a dangerous cycle of robbing Peter to pay Paul.

And a classic red flag? That dread you feel when an envelope from the Australian Taxation Office (ATO) arrives, fearing a notice you can't possibly handle. These aren't just business challenges; they are warning signs of potential insolvency.

The Litmus Test for Solvency

Insolvency isn't just about having zero dollars in the bank. The legal test here in Australia, defined by the Corporations Act 2001, is whether your company can pay its debts as and when they fall due. You might have assets on paper, but if you can't turn them into cash to pay a supplier on their 30-day terms, you could be trading while insolvent.

Australian Securities and Investments Commission (ASIC) provides a pretty clear checklist of common indicators to help directors figure out where they stand.

Your Quick Business Health Checklist

You don’t need an accounting degree to get a gut-check on your business’s health. Ask yourself these honest questions today:

Cash Flow: Is our operating cash flow consistently negative? Are we constantly chasing payments just to cover immediate expenses?

Supplier Relationships: Are we stretching payment terms with suppliers beyond 60 or 90 days? Have any suppliers put us on a "cash-on-delivery" basis?

ATO Obligations: Are our Superannuation Guarantee Charge (SGC), Goods and Services taxation (GST) and Pay As You Go (PAYG) withholding payments up to date? Or are we treating the ATO as a funding source? Outstanding tax lodgements and then tax debt is a massive indicator of insolvency.

Financial Reporting: Can we produce accurate financial records quickly, or are our books a mess? You can't make good decisions if you're flying blind.

Debt Levels: Are we leaning on overdrafts or credit cards to fund daily operations? Have we received any letters of demand or legal threats from creditors?

Answering "yes" to even a couple of these doesn't mean your business is doomed. What it does mean is you have a critical window of opportunity to act. Getting onto a pre-insolvency advisor early can unlock powerful options like the small business restructuring process, which allows you to stay in control while creating a viable plan for the future.

Navigating Your Legal Duties as a Director

When your business hits some serious financial turbulence, your legal responsibilities as a director suddenly get a whole lot heavier. Under Australian law, you've always got a duty to act in the best interests of the company. But when insolvency is on the horizon, that duty expands to include protecting the interests of your creditors.

The biggest one you need to get your head around is the duty to prevent insolvent trading. This isn't just a friendly suggestion; it's a hard-and-fast legal requirement under the Corporations Act 2001. If your company racks up a new debt when there are reasonable grounds to suspect it's insolvent (or that the new debt will make it insolvent), you could be held personally liable.

Think about it this way: if you order a heap of new stock on a 30-day account, knowing full well you can't even pay your existing suppliers, you're treading on very dangerous ground. The consequences aren't trivial, either. They can range from civil penalties and having to personally compensate creditors to, in the really bad cases, criminal charges.

A Rough Patch vs. True Insolvency

Every business has its tough months, so how do you tell the difference between a temporary cash flow squeeze and actual, legal insolvency? The test is simple in theory but can be tricky in practice: can your company pay its debts as and when they fall due?

Notice it’s not about your total assets versus your total liabilities. You could own a building worth millions, but if you don't have the cash on hand to pay your staff their wages on Friday, you may be insolvent. It’s a cash flow test, not a balance sheet test.

To really get to grips with this, it's worth digging deeper into the specifics of insolvent trading in Australia. Getting these details right can be the difference between a successful turnaround and personal financial disaster.

Beyond Liquidation: Exploring Your Real Restructuring Options

When debt starts to pile up, it’s easy for a director's mind to jump straight to the worst-case scenario: liquidation. I’ve seen countless business owners who believe it's the only option left on the table. But that’s one of the biggest—and most costly—misconceptions in Australian business recovery.

Liquidation is an end-of-the-road process. It’s final. But before you even get there, a whole suite of powerful recovery pathways exists, designed specifically to save a viable business, not just shut it down.

The key is shifting your mindset from "closing the doors" to "fixing the business." Once you do that, a range of strategic possibilities opens up. Let’s walk through what they actually look like in practice.

Informal Workouts: The Direct Approach

Before getting tangled in formal legal processes, the simplest path is often an informal workout. This is where you, or an advisor like us, get on the phone and negotiate directly with your key creditors—think the major suppliers, or your landlord, or your bank. The goal is to agree on a temporary or permanent change to your payment terms, all without ever stepping near a courtroom.

I worked with a construction company recently that was hit by unexpected project delays. They simply couldn't make their next payment to their primary materials supplier. Instead of burying their heads in the sand, we negotiated a three-month payment pause. This gave them the breathing room they needed to finish the project, get paid, and catch up.

The beauty of this approach is its flexibility, low cost, and complete privacy. But it all hinges on goodwill. If even one major creditor refuses to play ball, the whole house of cards can fall, forcing you to look at more structured solutions.

Voluntary Administration and DOCAs

When informal chats aren't cutting it, Voluntary Administration (VA) is a more formal, heavy-duty option. This is where you appoint an independent voluntary administrator who takes full control of the company. Their job is to dig into the company's affairs and recommend the best way forward for creditors.

Often, the goal of a VA is to propose a Deed of Company Arrangement (DOCA). This is a binding deal between the company and its creditors (of more than $1million in total debt (regardless of whom the debt is owed to)), in order to settle its debts for less than the full amount owed. A successful DOCA allows the business to keep trading and wipe the slate clean. However, it comes at a cost: directors lose all control during the voluntary administration period, the process is both public and expensive and you are in the hands of your creditors approving the arrangement. As such if you have made many promises to your creditors and not fulfilled them, then they may be less likely to vote in favour of your DOCA propsal no matter how many cents in the dollar they are going to receive.

A DOCA can be a powerful tool, particularly for larger or more complex businesses. But for many small to medium enterprises, it's often overkill. The loss of control and the significant costs involved frequently make it a less appealing choice compared to newer, more streamlined alternatives.

The Small Business Restructuring Process: A Genuine Game Changer

Introduced back in 2021, the Small Business Restructuring (SBR) process was specifically designed to be a faster, cheaper, and more director-friendly alternative to VA. The single most important feature? You, the director, remain in control of your business throughout the entire process. No one else takes the keys.

You work alongside a registered restructuring practitioner to develop a plan to deal with your outstanding debts over time. That plan is then put to your creditors for a single, straightforward vote. It’s a powerful tool that effectively freezes unsecured creditor claims, giving you the space to formulate a viable path forward.

And the data shows it works. According to ASIC's recent Report, there were 3,388 SBR appointments from July 2022 to December 2023. Of those, an impressive 2,820 transitioned into approved SBR plans, while only 568 were terminated.

That’s an 83% approval rate. However we are seeing these rates on the decline with the ATO becoming tougher with the amount of information and level of detail needed before they will approve an SBR.

You can dig into the full findings in ASIC's report on small business restructuring outcomes.

When a viable plan is put on the table, creditors are often willing to support a restructure over a liquidation, where they know they’ll likely recover far less. For many small business owners, simply understanding the nuts and bolts of corporate debt restructuring is the first real step towards a successful turnaround.

The SBR process is designed for businesses with liabilities under $1 million that have kept their tax lodgements and employee entitlements up-to-date. If you qualify, it is hands down the most effective formal restructuring tool available in Australia today. It perfectly balances the need for creditor protection with the practical reality that the director is almost always the best person to run the business and lead its recovery.

Comparing Key Restructuring Options in Australia

To make sense of these pathways, it helps to see them side-by-side. Each has its own place, and choosing the right one depends entirely on your company's specific situation—its size, its debts, and whether the underlying business is still viable.

| Feature | Informal Workout | Small Business Restructuring (SBR) | Voluntary Administration (VA) | Liquidation |

|---|---|---|---|---|

| Director Control | Full control retained | Director remains in control | Control passes to Administrator | Control passes to Liquidator |

| Cost | Low (advisor fees only) | Moderate (fixed practitioner fees) | High (Administrator's fees) | Varies (low to medium) |

| Publicity | Private | Public (ASIC notice) | Public (ASIC notice & ads) | Public (ASIC notice & ads) |

| Outcome | Continue trading with new terms | Continue trading under a plan | Continue trading under a DOCA | Business ceases immediately and is wound up. |

| Best For | Early-stage issues with cooperative creditors | Viable SMEs with <$1M debt needing a formal freeze on claims | Larger/complex businesses needing a major reset | Insolvent businesses with no prospect of recovery |

This table is a starting point. The nuances of each process can have huge implications for you personally and for the future of your business. Getting the right advice at the right time is what makes all the difference.

How the Small Business Restructuring Process Works in Practice

So, you understand the theory, but what does the small business restructuring process actually look like on the ground? It's easy to get bogged down in legal jargon, but this is a defined, director-led pathway designed to give good businesses a fighting chance. It's not a legal maze.

Let’s walk through exactly what happens from the moment you decide to go ahead.

The whole thing kicks off the moment your company’s directors agree the business is insolvent (or is about to be) and you officially appoint a Small Business Restructuring Practitioner. This person is a registered liquidator, but think of them as your guide and facilitator, not your boss. Critically, you stay in control of the business and run it day-to-day.

From that appointment, the clock starts ticking. You and your practitioner have just 20 business days to put together a restructuring plan and get a proposal out to your creditors. During this time, there's a freeze on most legal action from unsecured creditors, giving you some much-needed breathing space.

Crafting a Compelling Restructuring Plan

That 20-day window is intense. This is where the real work gets done, and it’s about more than just crunching numbers—it’s about building a credible story for how your business will recover. Your practitioner will be right there with you, helping to tick some crucial boxes.

First up, you have to get all your outstanding tax lodgements up to date with the ATO. This is a non-negotiable part of the process. You also need to make sure every dollar of employee entitlements, especially superannuation, is fully paid up.

Next, it’s time to get your financial reports in order to paint a clear, honest picture of where things stand. This means identifying every asset and liability and, most importantly, putting together a realistic cash flow forecast that shows the business can trade profitably moving forward. You also need to identify what is going to change practically in the business for the future, so that creditors know that the businesses debt issues will not reoccur.

The heart of the whole process is the proposal you put to creditors. It spells out exactly how much of their debt you can repay and over what timeframe. A good proposal is one that your business can actually afford, while also offering creditors a better financial return than if the company just went into liquidation.

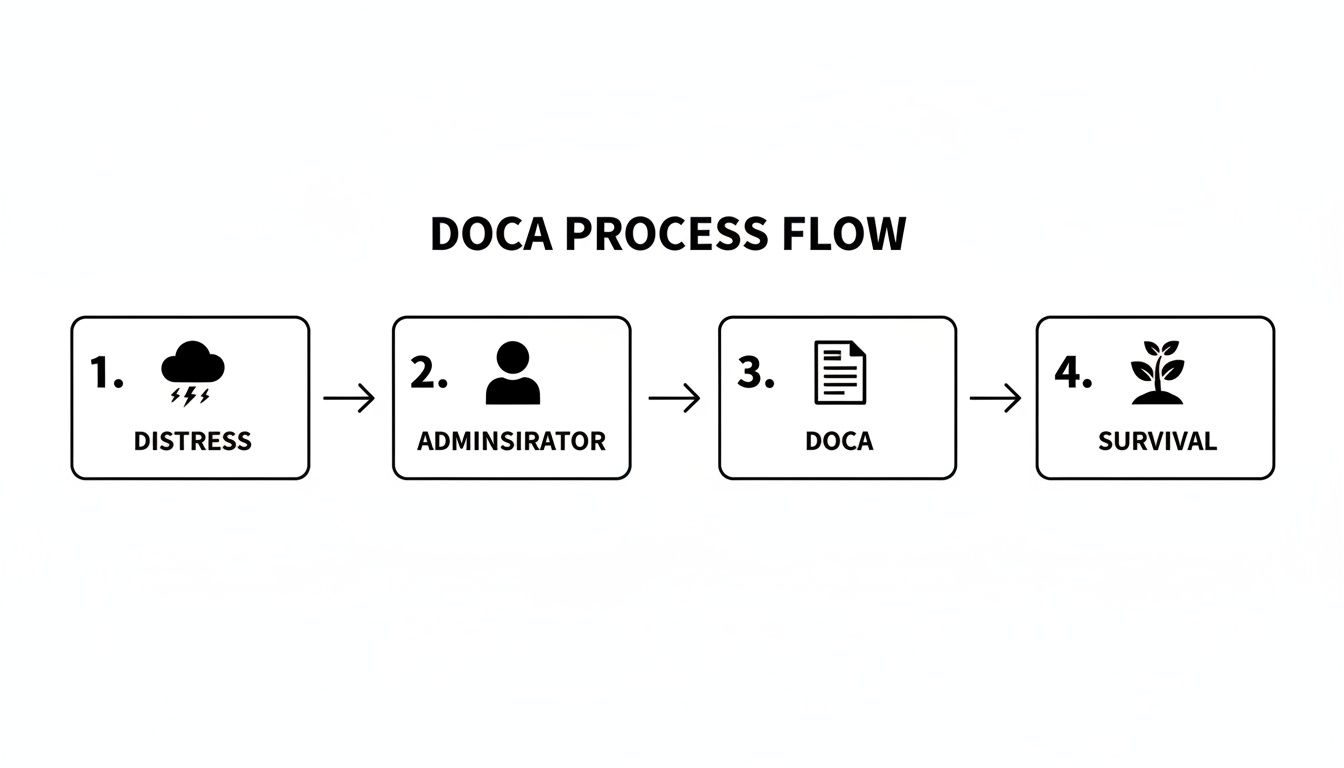

This diagram shows you exactly where the SBR process fits in. It’s a formal, structured middle ground for businesses that need more than an informal chat but aren't ready for the finality of liquidation.

As you can see, SBR is a vital lifebuoy. It’s for those situations where informal talks aren’t cutting it, but liquidation feels far too drastic.

The Creditor Vote and Plan Implementation

Once the proposal is finalised and sent out, your creditors get 15 business days to think it over and cast their vote. It’s a simple majority that decides it—if creditors who are owed more than 50% of the total debt vote 'yes', the plan is approved. It then becomes legally binding on all of your unsecured creditors.

If you get the green light, you move into implementation. You make the payments you agreed to in the plan to your practitioner, and they distribute the money to creditors. This might happen over a few months or even stretch out for a couple of years.

Once that final payment is made, the debts covered by the plan are legally gone. Your company emerges with a much cleaner slate, free to continue trading.

Let me give you a real-world example of how this plays out.

The Business: A commercial construction company here in NSW.

The Problem: They got hit with a perfect storm. Fixed-price contracts met soaring material costs and project delays. They were on the hook for $450,000 to suppliers and the ATO, but they had a solid pipeline of profitable work ahead.

The Action: The director brought in a practitioner and started the small business restructuring process. They worked together to build a plan that proved the business was viable once it could get past its legacy debt.

The Proposal: Their plan offered to pay creditors 40 cents in the dollar over two years, funded by profits from their upcoming projects. The alternative—liquidation—was estimated to return less than 5 cents in the dollar. A no-brainer, really.

The Outcome: Creditors overwhelmingly voted yes. The director kept control, the team stayed employed, and the company successfully traded its way out of a very tight spot.

This is the power of the SBR process in a nutshell. You can see more about how these strategies work by looking at a real-life complex business restructure we handled that saved a company from certain collapse. It's a structured, fair, and transparent way to reach a commercial outcome that works for everyone.

You also need to ensuire that an SBR is right for you and will not impinge upon any licences the Company has.

Putting the Plan Into Action and Keeping Everyone on Board

Getting your restructuring plan across the line with creditors feels like a massive win. It is, but it’s the starting gun, not the finish line. Now the real work begins. The focus has to pivot from planning to pure execution, and this is where the human side of the small business restructuring process really kicks in.

From this point on, your success hinges entirely on how well you manage the people who matter most: your team, your suppliers, and your customers. A brilliant plan on paper is worthless if you can’t bring them along for the ride. This phase is all about clear communication, rebuilding confidence, and proving your business has a real future.

Control the Narrative with Honesty

When a business goes through a restructure, the rumour mill can go into overdrive, causing anxiety to spread like wildfire. The only antidote is direct, honest, and regular communication. You have to own the story.

Your employees are your most critical audience. They need to hear what’s happening directly from you, not from whispers in the tearoom. Frame the restructure for what it is—a positive step towards securing the company’s future and their place within it.

Here’s a practical way to handle your internal comms:

Front Up: Explain what happened, why it was necessary, and what the approved plan means for the business going forward.

Focus on the Future: Make it clear that this process protects the company and saves jobs.

Acknowledge Their Fears: Let them ask the tough questions and give them straight answers. You'll build an incredible amount of trust this way.

The message to suppliers and customers is just as vital. They need reassurance that it’s business as usual and that you’re still a reliable partner. A simple, proactive phone call can make all the difference.

"I wanted to let you know we've just had a restructuring plan approved that secures our financial future. This process strengthens our operations and means we can continue trading as normal. We really value our partnership and look forward to working with you."

That kind of proactive chat stops suppliers from getting nervous and tightening your credit terms, which is the last thing you need.

The Hard Yards: Executing the Plan

With communication channels open, it's time for disciplined implementation. This means a laser focus on the financial targets you’ve committed to.

Your new budget is your roadmap. Every single decision gets measured against it. You'll need to meticulously manage new payment schedules, especially those locked in by your restructuring plan. Missing even one payment can put the whole arrangement at risk.

Here are a few non-negotiables:

Weekly Financial Huddles: Don't wait until the end of the month. Track your revenue, expenses, and cash flow against your revised forecasts in real-time.

Manage New Payments Religiously: Set up automated reminders for any payments due under your plan. Treat these deadlines as sacred.

Embed the Changes: If your plan involved streamlining operations or cutting costs, make sure those changes become part of your daily routine, not just a temporary fix.

The aim here isn't just to scrape through another quarter. It’s to build a genuinely resilient and sustainable business. The discipline you forge and the systems you implement now will become the bedrock for future stability and growth, long after this process is behind you.

Your Top Questions About the Restructuring Process, Answered

When your business is under financial pressure, the way forward can feel anything but clear. The small business restructuring process is a powerful lifeline, but naturally, you’ll have questions. Let’s tackle the most common queries we hear from directors every day, clearing up the confusion so you can act with confidence.

These aren't just hypotheticals; they're the real-world worries that keep business owners staring at the ceiling at 3 AM. Getting straight answers is the first step to getting back in the driver's seat.

Can I Still Run My Business During the SBR Process?

Yes, absolutely. This is the single biggest advantage of the Small Business Restructuring (SBR) framework and a key reason it was introduced in the first place.

Unlike other formal insolvency appointments where an administrator effectively takes the keys, the SBR process is designed for directors to remain in control. You’re still in charge of the day-to-day operations.

You keep managing your staff, serving your customers, and making the calls that run the business. The restructuring practitioner is there to guide you, help shape the plan, and deal with creditors, but they don't take over. This "debtor-in-possession" model recognises a simple truth: you know your business best and are the right person to steer it back to health.

How Much Does a Small Business Restructuring Cost?

It’s the million-dollar question, but thankfully the answer isn't a million dollars. While costs will vary depending on how complex your business is, the SBR process was specifically created to be a much more affordable and faster alternative to things like Voluntary Administration.

Any reputable practitioner will give you a clear, fixed-fee proposal upfront before you commit to anything.

It’s helpful to reframe the cost. Think of it not as an expense, but as an investment in survival. The fees are almost always a fraction of the devastating losses you’d face from liquidation, creditor lawsuits, or personal liability claims. The goal is to save the business and its value, a prize that dwarfs the cost of the process.

It's a classic case of spending a dollar to save ten. The cost of a well-managed SBR is minimal compared to the catastrophic financial impact of letting a viable business collapse under the weight of legacy debt that could have been resolved.

What Happens If My Creditors Reject the Restructuring Plan?

If your creditors vote against the plan, the SBR process formally ends. It can feel like a punch to the gut, but it's not the end of the road. At that point, you and your adviser regroup and look at the other options on the table, which could include a LemonAide Restructure, Voluntary Administration or, as a last resort, liquidation.

A well-prepared plan, developed with an experienced practitioner who knows what creditors are looking for, has a very high chance of getting over the line.

Will Restructuring My Business Affect My Personal Credit Rating?

The SBR is a formal process for the company, not for you as an individual. Because of this, putting your company into a restructure should not directly hammer your personal credit rating. While the company's credit file will show the appointment, that's entirely separate from your own file.

The big exception—and it’s a very important one—is personal guarantees.

If you've personally guaranteed company debts like a bank loan, a lease, or a major supplier account, those agreements are a separate matter. The company's restructuring plan doesn't automatically wipe out your personal liability under those guarantees. This is where specialist advice is absolutely critical, as dealing with these guarantees has to be a key part of your overall recovery strategy.

Start with a free, no-obligation review of your position by visiting https://www.lemonaide.com.au.