Discover what is a deed of company arrangement: A concise guide for directors

A Deed of Company Arrangement, or DOCA, is a formal and legally binding deal struck between a company on the ropes and its creditors. In simple terms, it's a powerful alternative to liquidation. It offers a genuine second chance, for a company with more than $1 million of debt, rather than just shutting the doors for good. The whole point is to come up with a better outcome for everyone involved than if the company was simply wound up.

Demystifying the Deed of Company Arrangement

When a company is in serious financial trouble, it can feel like the walls are closing in. Directors often think liquidation—the process of closing up shop and selling everything off—is the only path left. But a DOCA presents a completely different route, one that’s all about recovery and survival, not termination.

Think of it as a negotiated peace treaty. Instead of fighting a losing battle with creditors, the company, with the help of a voluntary administrator, puts forward a formal agreement. This agreement spells out a plan to pay back a portion of its debts over time. This allows the business to keep the lights on and work its way back to financial health.

A DOCA essentially hits the pause button on all the chaos. It puts a stop to most creditor claims, giving the company the critical breathing room it needs to restructure, stabilise, and roll out a recovery plan without the constant threat of legal action and winding-up applications.

Here's a quick rundown of what a DOCA is all about.

Deed of Company Arrangement at a Glance

| Feature | Description |

|---|---|

| Purpose | To provide a better return for creditors than liquidation while allowing the company to survive. |

| Process | Proposed by a voluntary administrator and voted on by creditors. |

| Binding Nature | Legally binds the company, its directors,priority creditors and unsecured creditors. |

| Key Outcome | The company continues to trade, usually with control returning to the directors. |

| Moratorium | Creates a "freeze" on most unsecured creditor claims while the DOCA is in effect. |

| Flexibility | Terms are flexible and can be tailored to the company’s specific circumstances. |

This table shows that a DOCA is a structured, strategic tool designed for survival, not just a last-ditch effort.

A Pathway to Survival, Not Closure

The fundamental goal of a DOCA is to deliver a better result for creditors than they’d get if the company was just liquidated. This is usually the main selling point when the administrator presents the proposal to them. For a DOCA to get the green light, creditors have to vote for it, believing that a restructured, trading business gives them a better chance of seeing their money in the long run.

This process is a cornerstone of Australian insolvency law, offering a flexible way forward for struggling companies. Its importance is clear from recent data; in the first half of FY2025, Insolvency Australia recorded 505 DOCA appointments out of a massive 10,268 total corporate insolvency cases. This shows just how critical the DOCA is as a tool for directors trying to navigate a tough economy, especially with pressures from entities like the ATO.

The benefits of a successful DOCA can be huge:

Business Preservation: The company keeps trading, protecting its brand, customer base, and spot in the market.

Director Control: Control of the company usually goes back to the directors, letting them drive the turnaround plan.

Employee Retention: It saves jobs and keeps the talented people who are essential for future success.

Ultimately, getting your head around what a Deed of Company Arrangement is is the first step toward using powerful restructuring and insolvency tools. It’s not about admitting defeat; it’s about making a proactive choice to rebuild and create a sustainable future for the business.

The DOCA Process from Start to Finish

Navigating the path to a Deed of Company Arrangement can feel like a maze, but it’s a well-defined and structured journey. The process is designed to be decisive, ensuring everyone involved—directors, staff, and creditors—gets clarity on the company's future as quickly as possible. It all kicks off the moment a company’s directors make the call to appoint a Voluntary Administrator.

This appointment is the first critical domino to fall. An independent insolvency professional steps in and takes control of the company. Their immediate mission? To get under the hood, investigate the business's financial health, and figure out the best possible path forward for all stakeholders.

From day one, the administrator’s job is to steady the ship and protect the company’s value. This investigation period is absolutely crucial, as it lays the groundwork for the recommendation they’ll eventually make to the creditors.

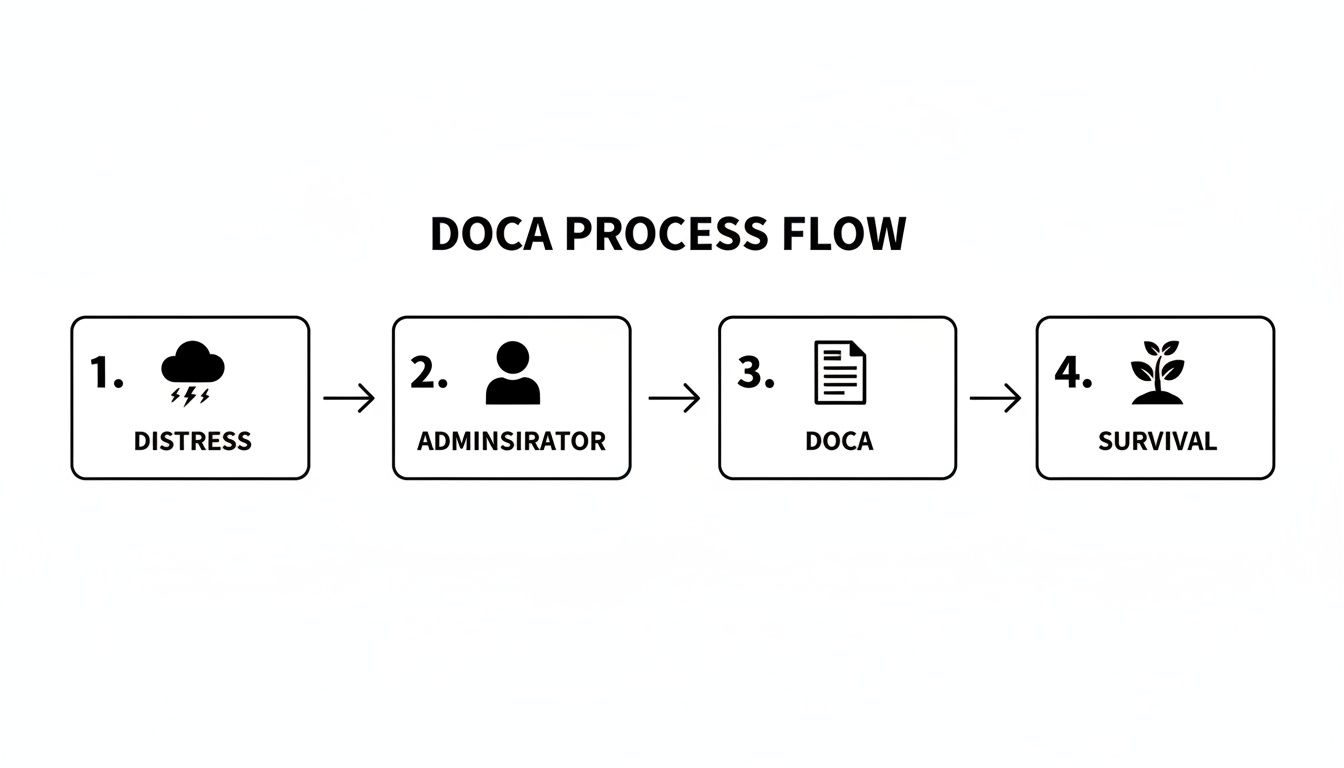

This flowchart maps out the typical journey from financial distress to a successful DOCA.

As you can see, it’s a structured rescue mission, built to guide a company from crisis towards a genuine shot at survival.

The First Creditors Meeting

Within eight business days of being appointed, the administrator must call the first meeting of creditors. This initial get-together has two main jobs. First, it’s a chance for the administrator to formally introduce themselves and walk everyone through how the voluntary administration process works.

Second, it gives creditors the power to form a committee of inspection. This committee, usually made up of a few of the larger creditors, acts as a sounding board. They can consult with the administrator and get more detailed updates, representing the interests of all creditors throughout the process.

The Administrator's Investigation and Report

After that first meeting, the administrator rolls up their sleeves and conducts a deep dive into the company's business, assets, finances, and general state of affairs. All their findings are bundled into a critical document called the Section 439A report.

This report is the cornerstone of the whole process. It gives creditors everything they need to make a properly informed decision. Inside, they'll find:

A summary of the company’s financial history and where it stands now.

The administrator's professional opinion on the three possible outcomes for the company.

A clear recommendation on which path is in the creditors' best interests.

The administrator has to weigh up three options: end the administration and hand the company back to the directors, approve a Deed of Company Arrangement, or tip the company into liquidation. Their recommendation is based purely on which path is likely to deliver the best financial return to the creditors.

This comprehensive report has to be sent out to all creditors at least five business days before the second, and far more important, creditors' meeting.

The Decisive Second Creditors Meeting

This is it—the moment of truth where the company's fate is sealed. Typically held within 25 to 30 business days of the administrator's appointment, this is where creditors vote on one of the three options laid out in the administrator’s report.

For a DOCA to get the green light, it needs to pass a dual resolution. Think of it as winning two votes at once. A majority of creditors must vote in favour based on both:

Number: More than 50% of the individual creditors present and voting.

Value: The creditors voting 'yes' must represent more than 50% of the total dollar value of the debt owed to those voting.

If the vote is split—say, most creditors in number vote for the DOCA, but the big-money creditors vote against it—the administrator gets a casting vote to break the deadlock. It’s a big responsibility, and any disgruntled creditor can challenge that decision in court. For directors, getting your head around the mechanics of a corporate restructure is vital for preparing for this phase.

If the creditors vote to accept the DOCA, the company and the administrator must sign the deed, usually within 15 business days. Once that ink is dry, the voluntary administration ends, the DOCA officially kicks in, and it becomes binding on all unsecured creditors. But if the proposal gets voted down, the company usually slides straight into liquidation.

How a DOCA Legally Affects Your Business and Creditors

Signing a Deed of Company Arrangement is a pivotal moment for a company in trouble. This isn't just another piece of paper; it’s a legally binding agreement that completely rewrites the rules of engagement for your company, its directors, and everyone you owe money to. It effectively draws a line in the sand, moving the situation from a chaotic scramble for payments to a structured, legally protected recovery plan.

The most immediate and powerful effect is what’s called a moratorium—a complete freeze on most creditor actions. Once the DOCA is signed, it binds all your company’s unsecured creditors. This means suppliers, contractors, landlords, and even the Australian Taxation Office (ATO) for certain debts are legally stopped from chasing the company for money owed before the administrator was appointed.

This legal shield holds firm even for creditors who voted against the DOCA. Their claims are now handled strictly under the terms of the deed, and they can't take separate legal action like issuing a statutory demand or trying to wind up your company. It’s a powerful tool that creates the breathing room needed to actually focus on a rebuild.

Unsecured Creditors Versus Secured Creditors

It’s absolutely vital to understand that a DOCA doesn't treat all creditors the same. While it forces the hand of unsecured creditors, the story is quite different for those holding security over the company's assets.

A secured creditor—think a bank with a charge over your property or equipment—generally isn't bound by the DOCA unless they specifically consent to be. They can often still enforce their security and repossess the asset. Having said that, many secured creditors will choose to support a DOCA if they believe a trading business gives them a better chance of getting their money back than a fire sale in a liquidation.

Employee entitlements get special treatment, too. The Corporations Act 2001 is very clear: a DOCA must ensure that things like unpaid wages, super, and leave are paid in full before other unsecured creditors see a cent, unless the employees themselves agree to a different deal.

The Commercial Reality After Signing

Legal jargon aside, a DOCA triggers huge commercial changes, most of which are aimed at getting the business back on its feet. Perhaps the most important shift is that control is returned to you.

Once the deed is executed, the company is handed back to the directors to manage day-to-day operations. You are back in the driver's seat, but you must steer the company according to the roadmap laid out in the DOCA's terms.

This return of control is a massive advantage over liquidation. It means you can:

Continue Trading: The business can keep its doors open, serve customers, and bring in revenue, which is often crucial for funding the payments under the DOCA.

Preserve Relationships: You get a chance to salvage relationships with key suppliers and customers, protecting the company’s hard-won goodwill and market standing.

Retain Key Staff: A DOCA allows you to keep your experienced team, and their skills are often the critical ingredient for a successful recovery.

This continuity is invaluable. It protects the brand you've built and sidesteps the destructive finality of a liquidation.

Implications for Company Directors

For directors personally, a successful DOCA can be a massive relief. One of the biggest fears for directors of a struggling company is an insolvent trading claim, where they can be held personally liable for debts racked up while the company couldn't pay its bills.

After a DOCA as been signed and as long as all terms are complied with, a voluntary administrator is not able to make directors personally lianle for the debts of the company through an insolvent trading claim. This protection is a powerful incentive for directors to act early and put forward a real turnaround plan—it’s a pathway to not only saving the business but also protecting their own financial position.

If the directors has been issued with a lockdown Director Penalty Notice ('DPN') from the ATO, a DOCA will not release the directors from personal liability of the DPN. The ATO may accept the DOCA and once the DOCA as been effectuated or finalised, the ATO may collect their remaining debt from all the directors persoally. If a non-lockdown DPN has been issued by the ATO, directors may avoid personal liability by placing the c ompany into Voluntary Administration within 21 days of the date of the DPN.

Choosing Between a DOCA and Liquidation

When a company hits the financial skids, directors are left staring down one of the toughest decisions they’ll ever make. It’s a fork in the road with two very different destinations: push for a Deed of Company Arrangement (DOCA), or accept the finality of liquidation. This isn’t just a numbers game; it's a strategic call that will dictate whether the business has a future.

Making that call means getting brutally honest about what each path entails.

Think of liquidation as the end of the line. It's a terminal process where the company’s story is over. The main job is to shut everything down, sell off the assets for whatever they can fetch, and give whatever’s left to creditors. A liquidator takes the keys, and the business as you know it is gone for good.

A DOCA, on the other hand, is a lifeline. It’s a structured rescue mission. The goal here isn't to close the book, but to write a new chapter. It's a legally binding deal designed to save the company or, at the very least, get a much better result for creditors than a liquidation fire sale ever could.

A Head-to-Head Comparison

To really get your head around the two options, you need to see them side-by-side. The consequences for everyone involved—directors, staff, and creditors—couldn't be more different.

This table cuts straight to the chase, comparing the things that truly matter when you're weighing up a DOCA against liquidation.

Comparing Key Outcomes: DOCA vs Liquidation

| Factor | Deed of Company Arrangement (DOCA) | Liquidation |

|---|---|---|

| Business Survival | Higher Potential. The entire point is to get the company trading again and back on its feet. | Zero. The business is shut down permanently, and the company is eventually deregistered. |

| Director Control | Returns to Directors. Once the DOCA is signed, control usually reverts to the directors to run the business under the new terms. | Lost Completely. A liquidator steps in and takes full control to wind up the company's affairs. |

| Employee Outcomes | Jobs Preserved. If the business keeps trading, employees usually keep their jobs. | Jobs Lost. All employment contracts are terminated as soon as the business stops operating. |

| Creditor Returns | Often Higher. Creditors almost always get a better return (more cents in the dollar) from a going concern than from asset sales. | Often Very Low or Zero. Unsecured creditors are at the back of the queue and frequently end up with nothing. |

| Personal Liability | Potential Relief. Can be a shield for directors against insolvent trading claims and help manage ATO Director Penalty Notices, if a non-lockdown DPN was issued and an appointment is made in time. | High Risk. The liquidator is required to investigate for insolvent trading, which can lead to directors being held personally liable for company debts. |

It's clear that from a survival and continuity perspective, the two paths lead to vastly different places. The DOCA is about rebuilding, while liquidation is about dismantling.

Why a DOCA Often Delivers a Better Outcome

The numbers don't lie. For creditors, liquidation is often a dead end. ASIC data shows that in a shocking 80% of insolvencies, unsecured creditors get absolutely nothing back. Not a cent. It’s a grim reality for suppliers who have extended credit in good faith. This is where a DOCA really shines, offering a structured path to a better return while keeping a viable business alive and people in jobs. You can find more insolvency statistics in this comprehensive report.

For directors, getting expert pre-insolvency advice on a DOCA isn't just about saving the business. It’s a crucial step in protecting their own personal financial position from things like Director Penalty Notices.

Understanding the Liquidator's Role

In a liquidation, the liquidator's mindset is completely different from an administrator's. Their legal duty is to the creditors, full stop. Their job isn’t to save the company; it’s to look backwards and investigate what went wrong.

A liquidator is required by law to investigate the company's affairs for any potential recovery actions. This includes scrutinising transactions for unfair preferences, uncommercial transactions, and, most critically, pursuing directors personally for insolvent trading.

This investigative power is probably the single biggest risk for directors facing liquidation. A DOCA, by contrast, is forward-looking. When creditors vote to approve it, the deal can include a release from those very claims, giving directors a shield that liquidation simply can't offer. You can learn more about what is the true role of a liquidator in our detailed guide.

Ultimately, the choice between a DOCA and liquidation boils down to one question: is there a viable business here worth saving? If the core business is sound but has been sideswiped by bad debt or a market downturn, a DOCA provides a way back. If the business is fundamentally broken, liquidation might be the only option left on the table.

Common DOCA Challenges and Recent Legal Trends

Getting a Deed of Company Arrangement over the line with creditors is a huge step, but it’s definitely not the end of the story. A DOCA isn't a magic wand for your company's problems; it's a fragile agreement that can run into serious trouble, sometimes even getting torn up by the courts. If you're a director thinking about proposing one, you need to know what can go wrong.

The most common reason a DOCA falls apart is painfully simple: the company can't hold up its end of the bargain. If you miss the scheduled payments into the creditor fund or breach another important part of the deal, the Deed Administrator's hands may become tied. They'll likely have to terminate the DOCA, and that usually means the company tumbles straight into liquidation.

But the challenges can start much, much earlier. A DOCA can be legally challenged and thrown out if it's seen as unfairly prejudicial to a particular creditor or group of creditors. This is where the fairness and real-world viability of your proposal get put under a microscope.

The Courts and the Tax Office Are Watching Closely

Over the last few years, Australian courts have stopped rubber-stamping DOCAs. They're taking a much harder look at the terms and are more willing than ever to terminate deals that don't feel right, even if they technically scraped through a creditor vote. This is especially true if the DOCA looks like it's designed to benefit directors or related parties at the expense of everyday, arms-length creditors.

Revenue authorities, particularly the Australian Taxation Office (ATO), have become a major force in this space. They are aggressively challenging DOCAs they believe are unfair, and it’s not hard to see why.

The big lesson from recent court cases is this: a DOCA has to be more than just a slightly better deal than liquidation. It must be genuinely fair and not crush any single group of creditors. A plan that only wins on a technicality, without real commercial backing from the majority of creditors by value, is living on borrowed time.

For example, courts have recently thrown out DOCAs where:

The DOCA only was approved by related paries: A large creditor forced the vote through, ignoring the wishes of dozens of smaller, independent businesses.

The offer was insulting: The dividend proposed for creditors was so tiny it wasn't seen as a genuine compromise.

Creditors were kept in the dark: The administrator didn't provide enough information for creditors to make a properly informed decision about the company's future.

Why Your Proposal Has to Be Rock-Solid

All these legal trends point to one critical fact: your DOCA proposal needs to be robust, commercially realistic, and completely transparent. It's no longer enough to just offer creditors a few more cents in the dollar than they'd get from a liquidation fire sale.

A proposal that works needs meticulous planning and a brutally honest look at whether the company can actually trade its way back to health. This is exactly why getting expert pre-insolvency advice isn't just a good idea; it's essential. An experienced advisor can help you see around corners, anticipate objections from creditors like the ATO, pressure-test your forecasts, and build a DOCA that is fair, achievable, and can stand up in court. Getting it right from the beginning massively boosts your chances of pulling off a successful restructure and giving your company a real future.

When to Get an Expert on Your Side for a Deed of Company Arrangement

Getting your head around what a Deed of Company Arrangement is and how it stacks up against liquidation is a great first step. But let's be clear: navigating this legal minefield isn't something you should ever attempt on your own. Deciding to go down the DOCA path needs careful, proactive planning and specialised advice from the very first hint of financial trouble.

Waiting for a full-blown crisis before calling for help is one of the most common—and expensive—mistakes directors make. Getting a pre-insolvency advisor on board early can honestly be the difference between a successful restructure and a collapse that could have been avoided. The moment you start finding it tough to pay suppliers, you're falling behind on ATO lodgements, or you just feel that constant pressure from mounting debts—that's the time to act.

The Value of a Pre-Insolvency Specialist

A dedicated pre-insolvency advisor, like the team here at LemonAide, plays a completely different role to a voluntary administrator. Our first and only duty is to you, the director, not your creditors. Think of us as your advocate, strategist, and guide through what can be a very daunting process.

Expert pre-insolvency guidance is all about crafting a viable restructuring plan that creditors will actually approve, while simultaneously shielding you from personal liability. It’s about building a rock-solid foundation for a DOCA that not only saves the business but also secures your own financial future.

Bringing in an advisor early gives you a few massive advantages:

An Objective Look: We’ll take a hard, unbiased look at your company's financial state to figure out if a DOCA is a realistic and genuinely beneficial path forward.

Strategic Game Plan: We help you put together a commercially sensible proposal that gets ahead of creditor concerns, especially from big players like the ATO.

Liability Shield: We give you straight-up advice on your director duties, helping you use the insolvency provisions to your advantage and cut down the risk of being held personally liable for insolvent trading.

Negotiation Backup: We’re in your corner, helping you frame the proposal in a way that gives it the best possible chance of getting the green light from creditors at that all-important second meeting.

At the end of the day, a Deed of Company Arrangement can be a powerful tool for hitting the reset button financially. By getting expert advice before the situation gets critical, you give yourself the strategy and support you need to restructure successfully, save your business, and move forward with confidence.

Your Burning DOCA Questions, Answered

When you're staring down the barrel of company insolvency, concepts like a Deed of Company Arrangement can throw up a lot of specific, practical questions. It’s completely normal. Let’s cut through the noise and tackle some of the most common queries I hear from directors every day.

Can I Still Run My Business During a DOCA?

Yes, in most cases, you’re back in the driver’s seat. Once the DOCA is officially signed and locked in, control of the company usually flips back to the directors. You're the one managing staff, dealing with customers, and bringing in revenue again.

But it’s not a complete free-for-all. You have to run the business strictly by the rules laid out in the DOCA—it's a legally binding agreement, after all. The deed administrator hangs around in an oversight role, mainly to make sure you're holding up your end of the bargain, like making the agreed-upon payments to creditors.

What Happens to My Personal Guarantees Under a DOCA?

This is a big one, and you absolutely need to get this straight: a DOCA does not wipe out your personal guarantees. Think of the DOCA as a deal between your company and its unsecured creditors. Any creditor who holds your personal guarantee can still come after you, personally, for the debt.

So, if you personally guaranteed that big business loan from the bank, they can still chase your house or personal savings, even while the company is protected. This is exactly why you need advice that looks at the whole picture—your company’s position and your personal financial exposure.

A Deed of Company Arrangement is a corporate fix, not a personal one. It deals with the company's debts. Unless you specifically negotiate a separate settlement, you have to assume your personal guarantees are still live and very much in play.

How Long Does a Deed of Company Arrangement Last?

There’s no set timeframe; it’s not like a prison sentence. The duration of a DOCA is whatever the creditors agree to. It's completely tailored to the proposal on the table.

I've seen DOCAs wrap up in just a few months, especially if the plan involves a simple one-off lump sum payment from a new investor. On the other hand, a DOCA could stretch out for several years if it’s funded by contributions from the company’s future profits. Once every obligation in the deed is met, the DOCA terminates, and you get the company back, free and clear of all the historical debts it covered.

What Is the Success Rate of a DOCA?

Honestly, success comes down to one thing: how realistic the plan is. Plenty of DOCAs get over the line successfully, giving good businesses a second chance to not just survive but really kick on.

But failure is always a possibility. If the company breaks a major term of the deal—and the most common breach is missing a payment—the fallout is swift and severe. The deed administrator will almost certainly terminate the DOCA, and the company will tip straight into liquidation. There’s no second-second chance. That's why putting together a proposal that is genuinely achievable is the most critical part of the entire process.

Is it time to chat?

Figuring out what a Deed of Company Arrangement really is and if it’s the right move for your business requires a guide who's been through the trenches. At LemonAide, we provide clear, strategic advice that considers your unique business and personal situation, making sure the decisions you make today protect you tomorrow. Contact us for a free, no-obligation chat at https://www.lemonaide.com.au.